What Are Accounts Payable and Accounts Receivable?

Understand accounts payable vs accounts receivable, their differences, and how both impact your cash flow and business payments.

- Aug 03, 2025

-

Shyam Agarwal

Shyam Agarwal

Understand accounts payable vs accounts receivable, their differences, and how both impact your cash flow and business payments.

Shyam Agarwal

Shyam Agarwal A friend of mine runs a mid-sized trading company. Every month, he’s caught in the same vicious cycle: customers delaying payment, and vendors expecting theirs on time. The push and pull of accounts payable and accounts receivable had him constantly worried about cash flow.

He once asked me, “What is accounts receivable and payable, really?” My answer was simple: accounts receivable and accounts payable are examples of everyday promises; money owed to you, money you owed to others. Managing both well is what separates businesses from each other.

That is one of the main reasons he turned to software for accounts receivable and payable. With AR and AP automation software, he stopped juggling papers and late-night spreadsheets. Instead, he got a clear view of what’s due, what’s pending, and how much money was really in motion.

So, let’s break down the definition & basics of AP & AR!

Think of accounts payable as the stack of bills on your desk. It’s the money your business owes to suppliers, landlords, and service providers. Simply, it’s money going out.

Ignoring AP is like ignoring your phone bill. Miss a payment, and trouble follows. Late fees pile up, suppliers lose trust, and suddenly your cash flow feels like a leaky bucket. Keeping AP under control shows vendors you’re serious and keeps your business running smoothly.

Let's say for a second that you run a cafe. You buy coffee beans from a supplier today but mutually agree to pay for it in 20 days. Until you send that payment, the invoice sits under accounts payable. You can’t call it debt in the scary sense, just a short-term promise you have made.

AP gives you a picture of what’s due and when. If it is too high, you know a lot of money is about to leave. If it is managed well, it keeps your cash flow balanced. Many businesses now use AR and AP automation software to stay on top of it.

To clearly understand what is accounts receivable, think of it as the total amount customers owe your business for goods or services already delivered. It represents expected cash inflows and plays a key role in determining short-term liquidity.

If accounts payable is money going out, accounts receivable is money coming in. It’s the unpaid invoices from customers who bought your product or service but haven’t handed over the cash yet.

From an accounting perspective, understanding what is accounts receivable in accounting helps businesses record earned revenue correctly while tracking outstanding customer balances on the balance sheet. Think of it as your future cash. When customers delay, your cash flow gets squeezed, even if sales look good on paper. Keeping receivables under control means your business has the fuel it needs to grow.

Looking at examples of accounts receivable such as unpaid customer invoices, subscription fees, or credit sales helps businesses recognize receivables across different industries and billing models.

Let's go back to the same cafe. A corporate client orders coffee catering for an event and promises to pay in 15 days. Until the payment arrives, that invoice sits under accounts receivable. It’s money you’ve already earned in a way. It’s just not in your bank account yet.

Knowing why accounts receivable is important helps businesses see how unpaid invoices directly impact cash flow, growth planning, and financial stability. Well-managed receivables ensure sales actually turn into usable cash.

Accounts receivable show how much money you’re waiting on and how healthy your collections are. If AR keeps piling up without payments, it’s a warning sign. That’s why many companies now rely on software for accounts receivable and payable, especially AR automation software, to track who owes what and send reminders without the awkward chasing.

Cash flow is the lifeblood of any business. Accounts receivable and accounts payable are examples of the everyday money movements that decide if your cash flow is smooth or shaky.

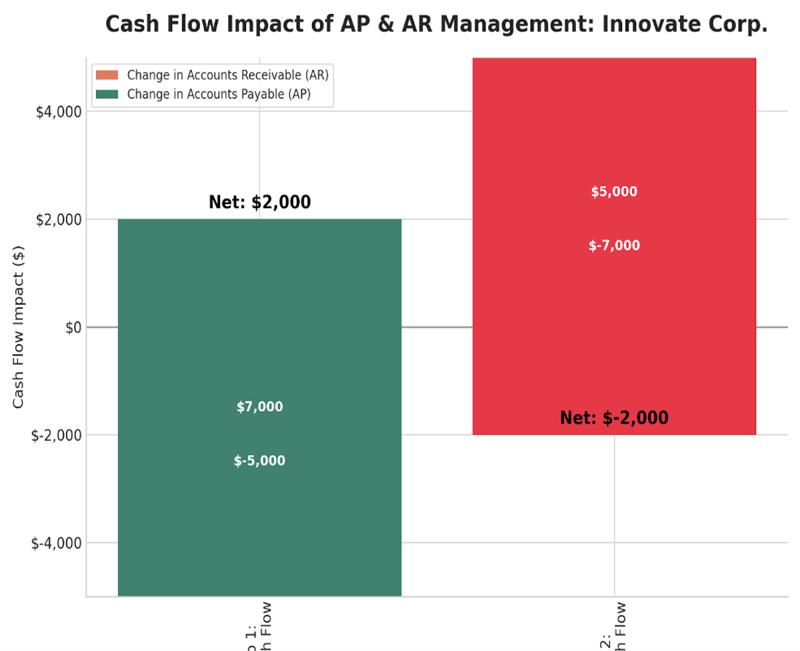

To give you an example of how this works in real life, let’s look at a fictional company called Innovate Corp. It’s the perfect example of how accounts receivable (AR) and accounts payable (AP) can completely change the way cash moves in a business.

Here, as we can see, Innovate Corp. Is handling money well.

Add it all up, and the company ends up with an extra $2,000 in positive cash flow. You could say that they have got breathing room.

Now, let’s flip the scene.

Altogether, this puts them $2,000 in the negative. Less cash in hand with more stress for the business.

The bar graph above makes the difference very easy to see. Strong AR and AP management means extra cash. While poor management leads to a cash crunch. And that is why most companies turn to AR and AP software or AR AP automation. It keeps things smooth, predictable, and less stressful.

Handling accounts receivable and accounts payable on your own can get messy. One missed invoice, one late payment, and suddenly cash flow feels tight. It’s stressful and can take up too much of your time. Time that you can spend doing something more profitable.

That’s why many businesses switch to AR and AP automation software. It does the boring, repetitive stuff for you, like sending reminders, tracking who paid and who has not, and scheduling supplier payments.

With tools like AR automation software or full AR AP automation, you get a clear snapshot of your money. Cash flow feels steady, vendors get paid on time, and customers are less likely to forget their bills.

Most businesses don’t struggle because of sales. They struggle because cash gets stuck in unpaid invoices. You can have plenty of orders, but if customers don’t pay on time, the cash flow gets stuck. Bills will inevitably pile up, and your growth will slow down.

That’s exactly what Quick Receivable is built to solve. Instead of trying to do a hundred different things, they put all their energy into helping you collect faster.

With their AR automation software, you don’t have to spend all night checking and cross-referencing spreadsheets or writing those truly awkward follow-up emails. Quick Receivable keeps track of every invoice, sends polite nudges when payments are late, and gives you a full view of what’s still pending.

Not at all. You still see every detail. The difference is that someone else is handling the follow-ups, so you stay informed without doing the legwork.

When all is said and done, accounts receivable and accounts payable are examples of the everyday money flows that decide if your business feels healthy or stressed. AR shows how much is coming in, AP shows how much is going out. Together, they shape your cash flow.

Managing them well is the difference between an average and great business with confidence to grow. That is where tools like AR and AP automation software can help. And if you want some extra support on the receivables side, Quick Receivable is here to make collections simple, clear, and stress-free.

Your business has already earned the money. Now it’s time to make sure it actually reaches your account.

Ready to bring more control to your receivables? Get in touch with Quick Receivable today!

Whether you're looking to streamline invoicing, set up secure online payments, or need a custom made payment solution, our team is always ready to help you move faster, safer, and smarter with QuickPayable.