Our Application

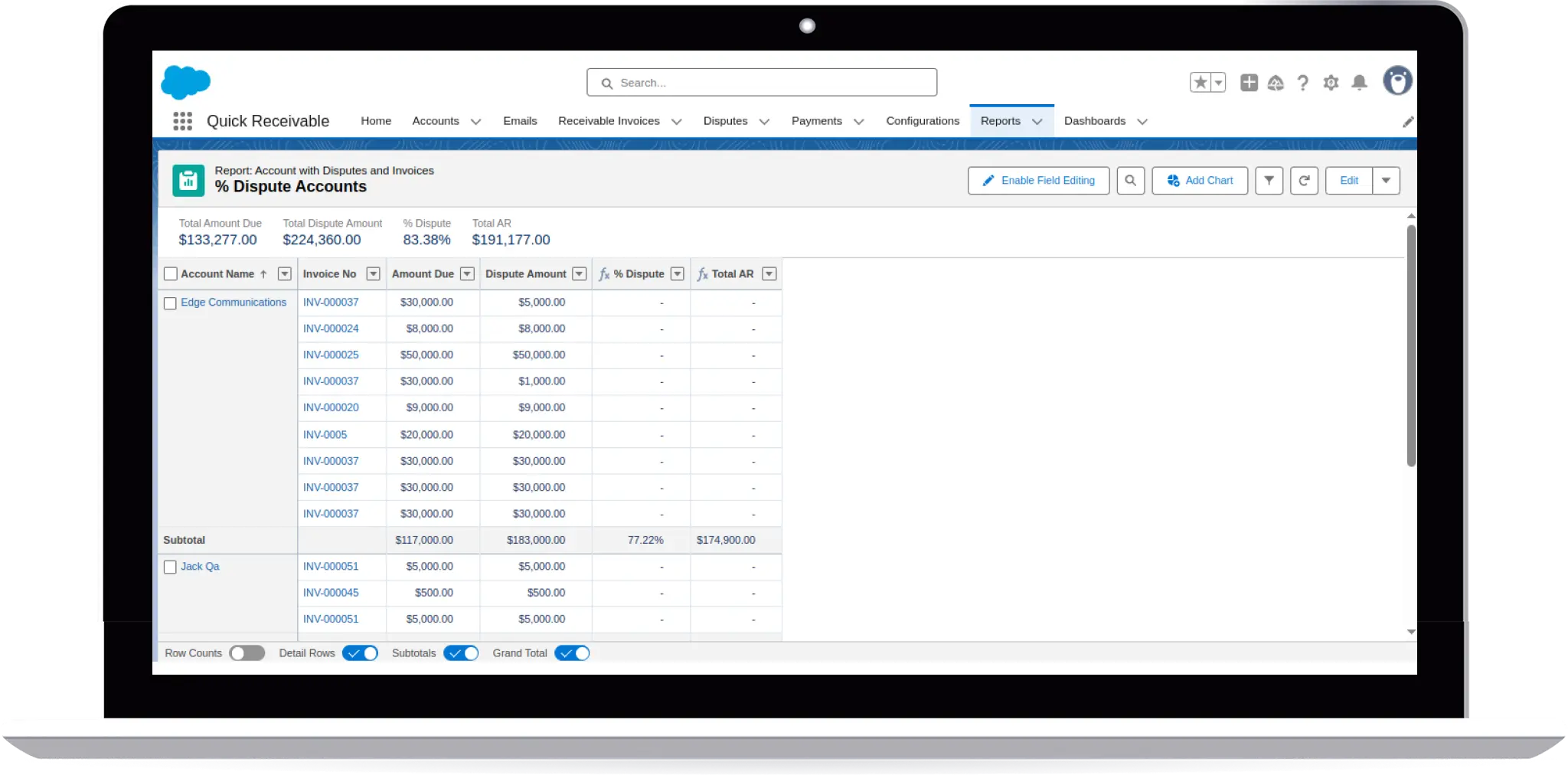

Well Formatted & Summarized Reports

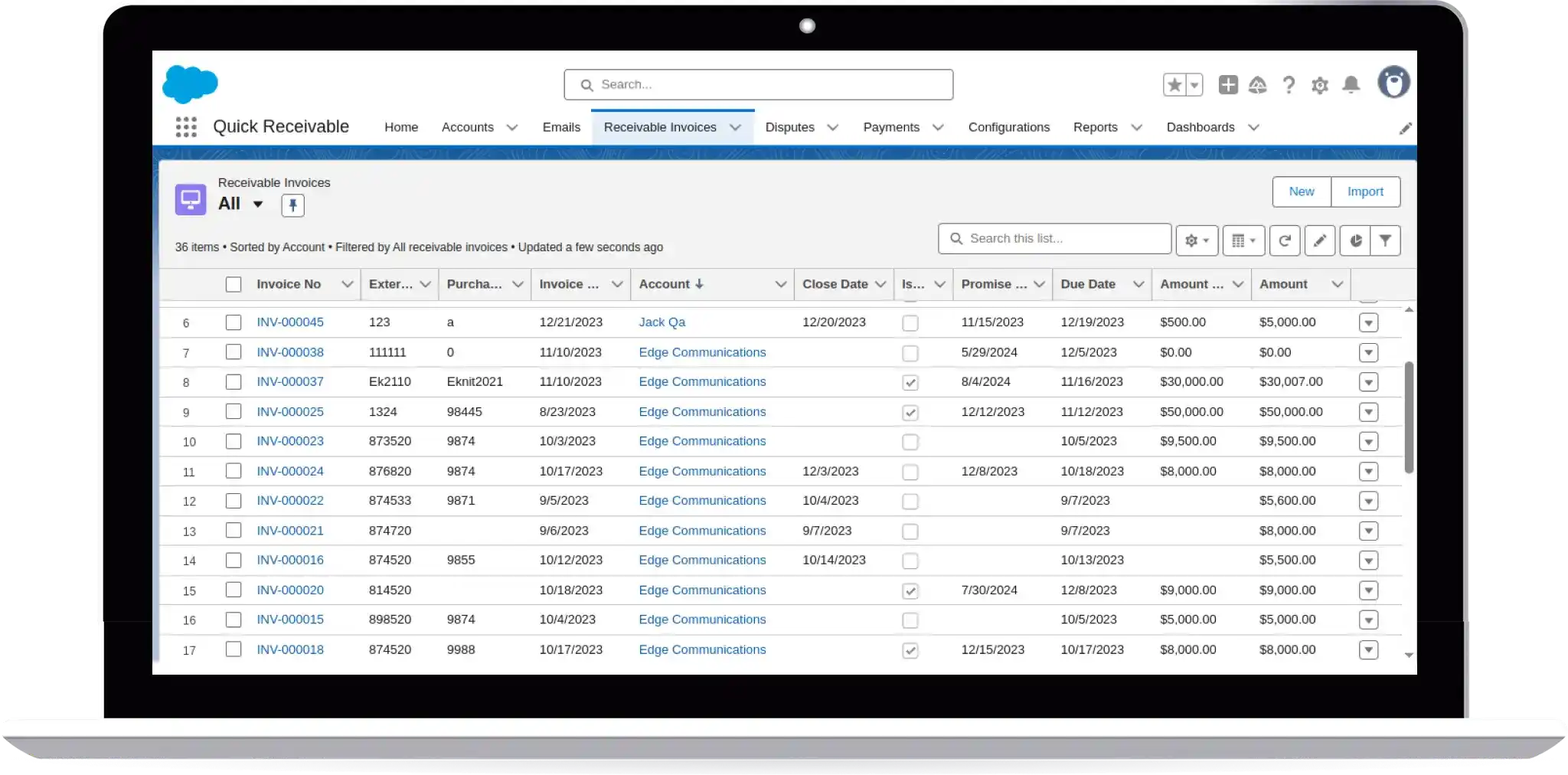

Simplify Invoice Management

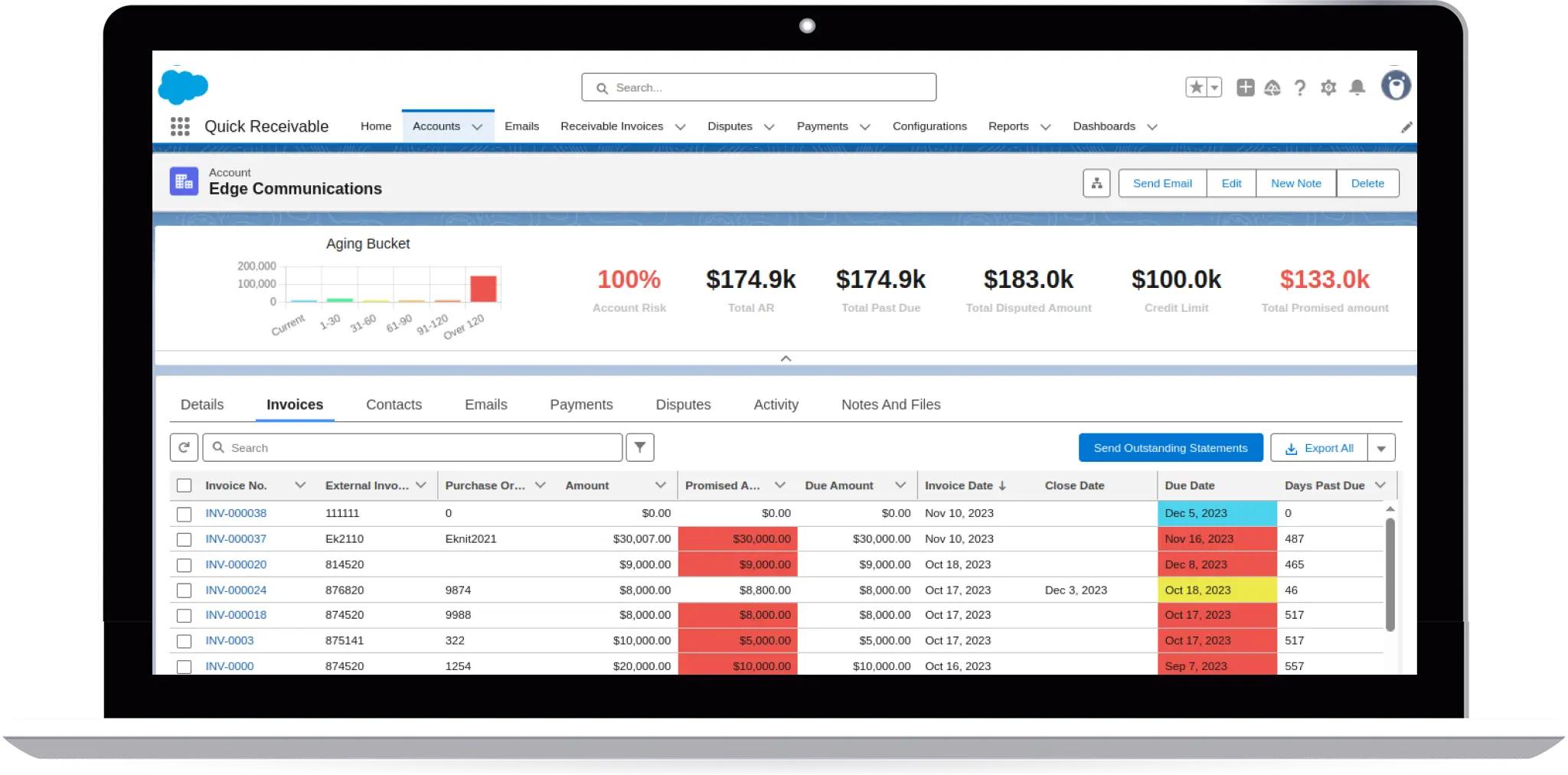

Effortlessly Track & Manage Account-Specific Data

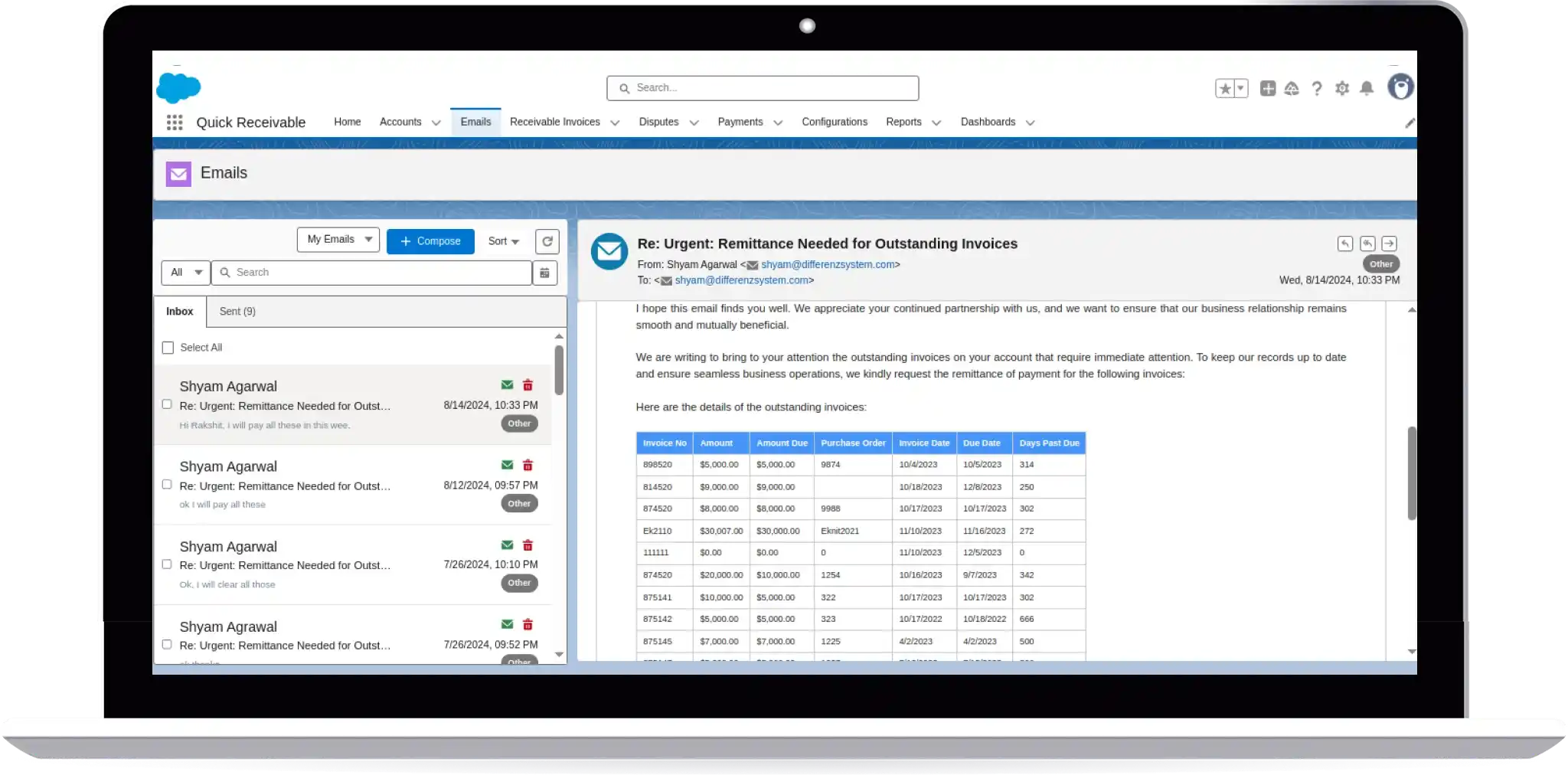

Seamlessly Manage & Track All Your Invoice Communications

Quick Receivable puts your entire accounts receivable process in one place, so you can see what’s due and act fast. It removes the need to switch between tools or search through emails, letting your team focus on getting paid on time.

Designed to work inside Salesforce, Quick Receivable fits your current setup and grows with your business. It keeps your payment process clear and easy to manage, helping you avoid delays and keep cash flow steady.

Schedule a Free DemoStore all customer details, invoices, and payment records together. This keeps everything organized and prevents missing important updates.

Track invoices from the day they’re sent until payment is received. You’ll always know which ones need action and which are complete.

Set up invoices to go out automatically every month, quarter, or year. This is helpful for long-term services or repeat billing needs.

Give your customers a secure place to view invoices, raise questions, and make payments. It helps reduce delays and back-and-forth emails.

Set up automated dunning emails to customers for overdue invoices. This reduces manual work and helps payments arrive sooner.

Track disputes by adding notes and updates to each case. You can follow progress clearly and avoid letting any issue slip through.

Match incoming payments with the correct invoices. This keeps your records clean and makes it easier to follow up on anything unpaid.

Store all emails, notes, and calls related to each account in one place. This helps your team stay informed and avoid repeat efforts.

Find, read, and respond to customer emails without switching tools. You can also link emails to specific invoices or accounts as needed.

Upload or update multiple records like invoices or payments at once. This saves time and avoids repetitive manual entry.

Log calls and write notes after each customer conversation. It helps your team keep track of what was discussed and what comes next.

Let your whole team access and work together with shared data. You can control who sees or edits what based on their role.

Download your invoices, reports, or payment details in PDF or Excel format. It makes them easy to share or use outside the system.

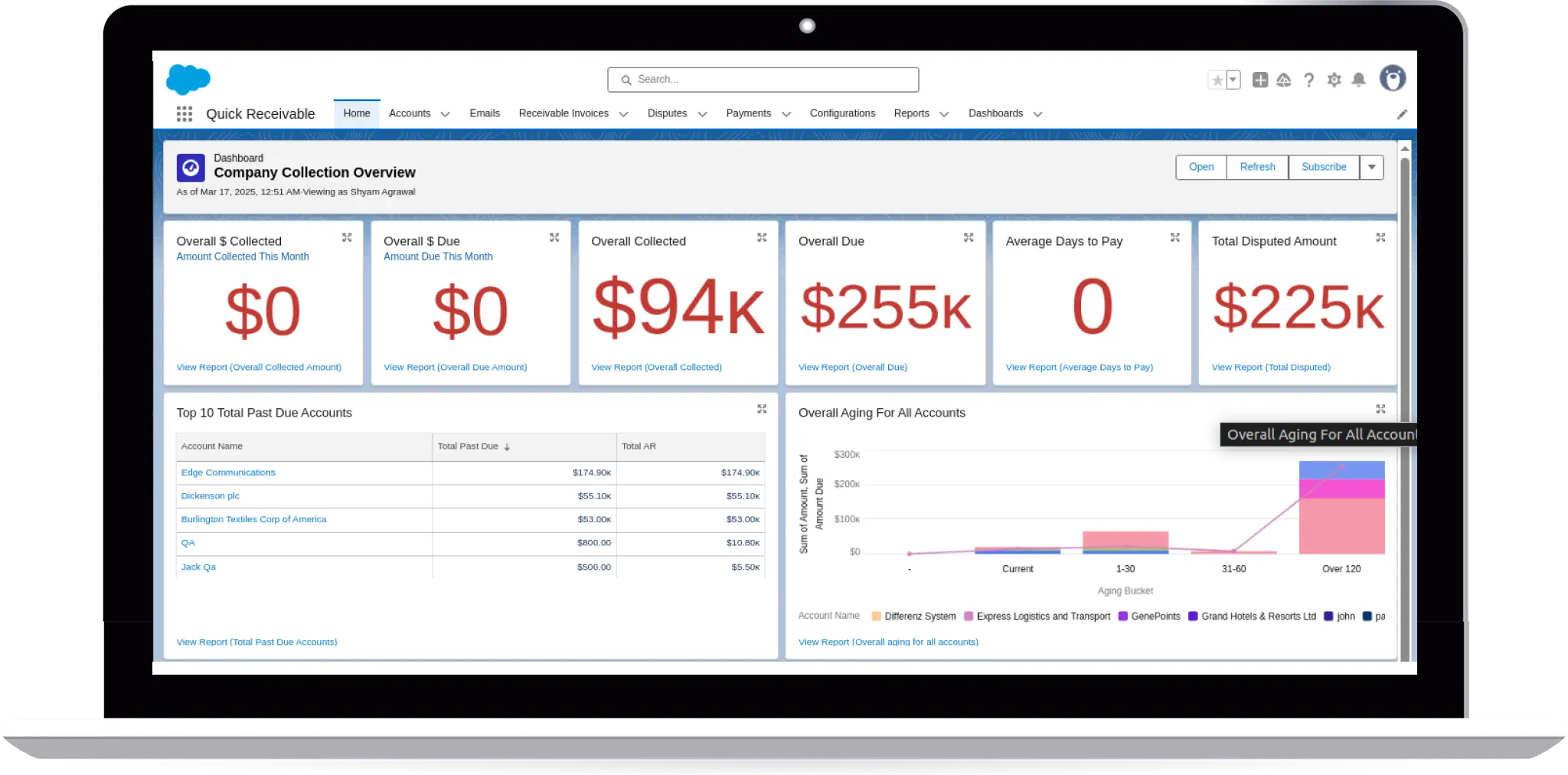

View your overall receivables in one simple screen. You can quickly see overdue amounts, open disputes, and total payments.

Create different reminder messages and schedules based on timing or customer type. This helps improve collections without extra effort.

Quick Receivable is designed to be simple for everyone. Your team can start using it right away without needing long training sessions.

Records customer commitments for future payments and triggers reminders with follow-ups if payments are missed.

Connects with your ERP system to keep financial data updated in real-time, reduce manual work, and improve accuracy in your reporting.

Quick Receivable flags invoices likely to face delays using customer behavior, due dates, and past trends.

Your team sees what needs action first without digging through lists.

Writing payment emails every day can feel repetitive and time consuming.

Our AI Draft Engine takes invoice data and instantly creates clear, professional emails, formatting the details neatly so your team saves time and always looks polished.

Getting the tone right with customers is often harder than it seems.

With tone adjustment, you choose the style such as formal, concise, or friendly, and the AI adapts the message while keeping the meaning clear, making communication consistent and natural.

No one enjoys searching through long contracts or policy files for a simple answer.

AI-Doc lets you upload a document and ask a question directly, giving you fact-based responses only from that file so your team gets reliable answers instantly.

Collections teams waste hours digging through cluttered inboxes.

Our email classification scans incoming messages, highlights the essentials like account names, invoice numbers, or disputes, and shows your team exactly what matters without extra effort.

Cash flow risks often go unnoticed until it is too late.

AI Insight studies customer payment patterns, overdue buckets, and credit use, then gives each account a risk score with suggested actions so your team can step in before issues grow.

Quick Receivable helps you stay ahead with automated alerts and clear tracking.

Manage Receivables Easily| Before Quick Receivable | After Quick Receivable |

|---|---|

| You wait for customers to reply to your follow-up email threads. | Customers get automated reminders with a direct payment link. |

| You dig through inboxes to find invoice conversations. | Every message and note is attached to the invoice itself. |

| You create the same invoice every month manually. | The system schedules and sends repeat invoices for you. |

| You don’t know which invoices are unpaid until someone checks. | The dashboard shows unpaid and overdue items the moment you log in. |

| You send reminders late or forget entirely. | Reminders go out on your schedule, without you lifting a finger. |

| Payment disputes sit unresolved for weeks. | Each dispute is tracked with notes and follow-up until it’s closed. |

| You’re always checking with teammates about the last actions taken. | Everyone sees the same account updates, calls, and status in one place. |

| You update payment records manually from your bank or email. | Payments are tracked and matched automatically. |

| You spend hours exporting and formatting reports. | Invoices and reports are ready to download in one click. |

Quick Receivable Features is a Salesforce-native SaaS solution built to simplify and streamline your accounts receivable process. From tracking invoices and automating reminders to managing disputes and gaining insights, it’s designed for teams who want clarity and control without extra tools or effort.

Developed by Differenz System Pvt. Ltd., Quick Receivable Features reflects our commitment to building smart, scalable, and user-focused business tools. With deep technical expertise and an eye for operational efficiency, our team builds a product that grows with your needs and continues to support your process over time.

Whether you’re a growing company or an established enterprise, Quick Receivable Features gives you the structure and support to collect smarter, faster, and more confidently within your Salesforce setup.