AI Powered AR Agents

Intelligent automation that executes your collection strategy flawlessly with AI-powered agents

Collections Agent

Accelerate cash collection with intelligent, personalized follow-ups that adapt to customer behavior and payment patterns. Our AI-powered Collections Agent works 24/7 to reduce manual effort and dramatically improve collection efficiency.

Transform Your Collections Performance

Before Automation:

- Average DSO: 45-60 days

- Manual follow-ups: 3-4 hours per collector daily

- Collection effectiveness rate: 35-40%

- Average time to first contact: 5-7 days

- Past due accounts: 25-30% of AR

After Automation:

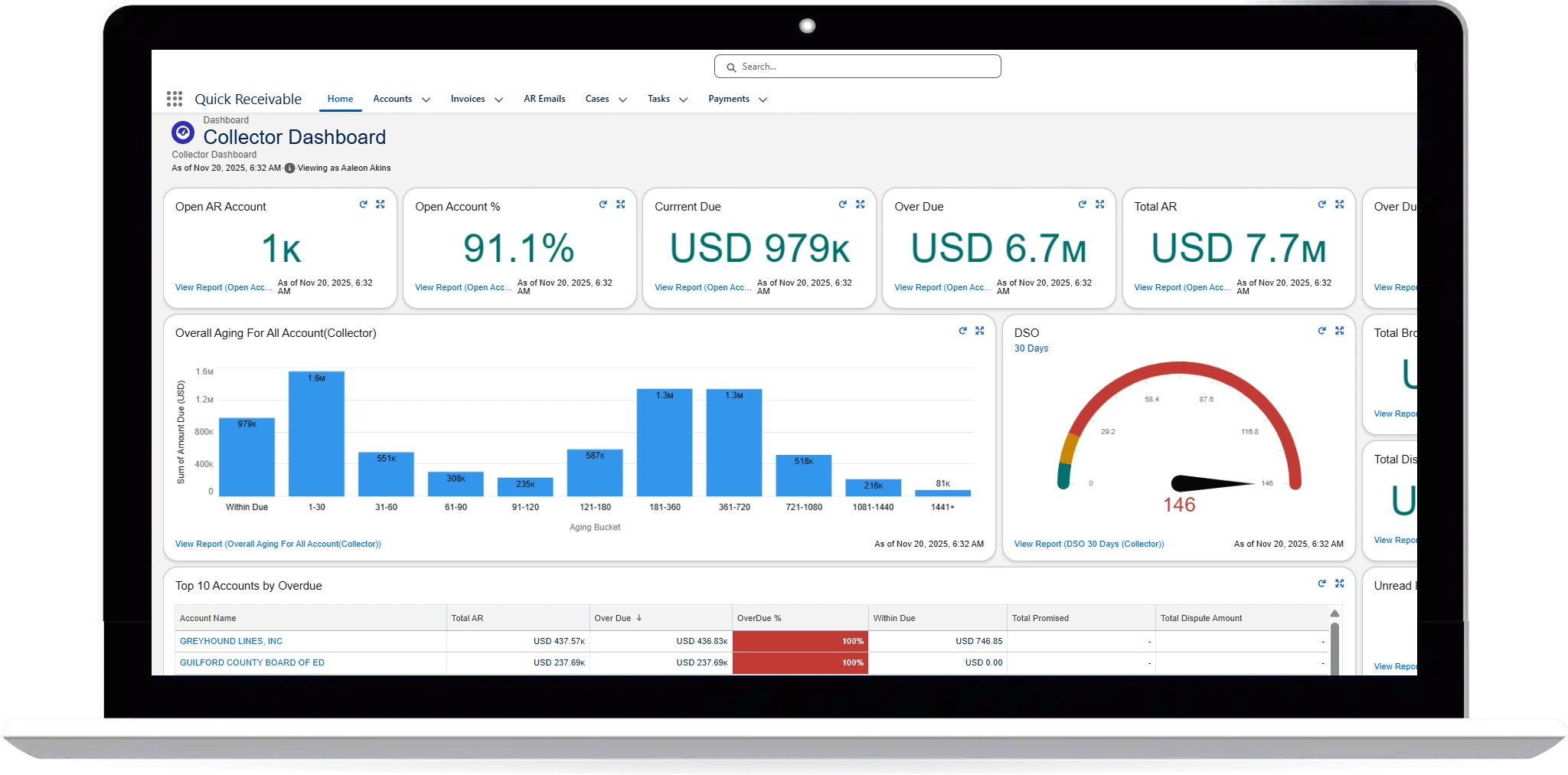

- Average DSO: 28-35 days (40% reduction)

- Manual follow-ups: 30-45 minutes per collector daily

- Collection effectiveness rate: 65-75%

- Average time to first contact: Instant

- Past due accounts: 12-15% of AR

Key Features:

- Automated Dunning Emails: Send personalized email reminders automatically at defined intervals with payment links and real-time tracking of opens and responses.

- Automated Dunning Calls: AI-powered voice calls with natural conversations and automatic call recording for compliance and quality assurance.

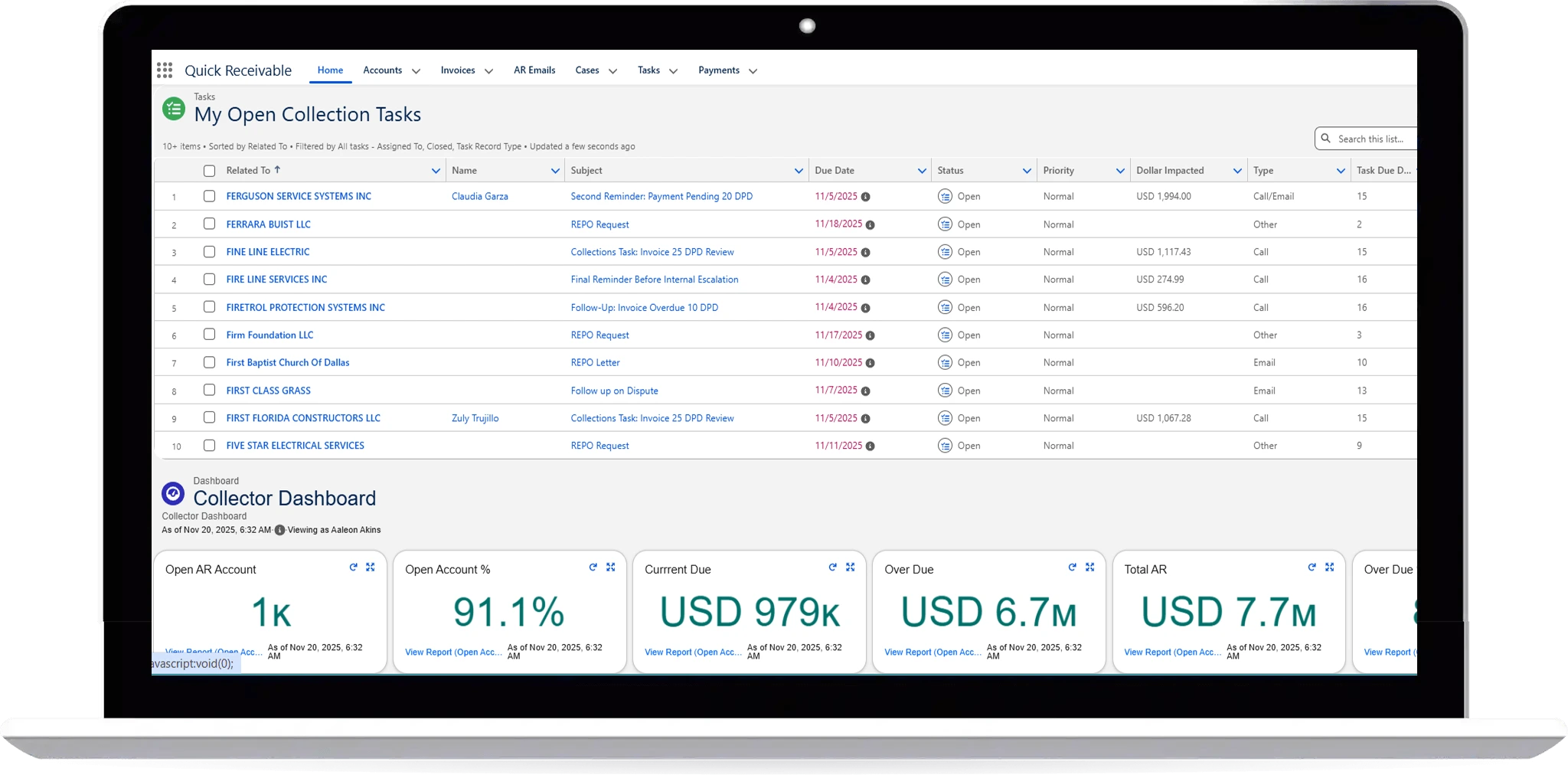

- Automated Dunning Tasks: Intelligently assign follow-up tasks to collectors based on account priority, aging, and workload distribution.

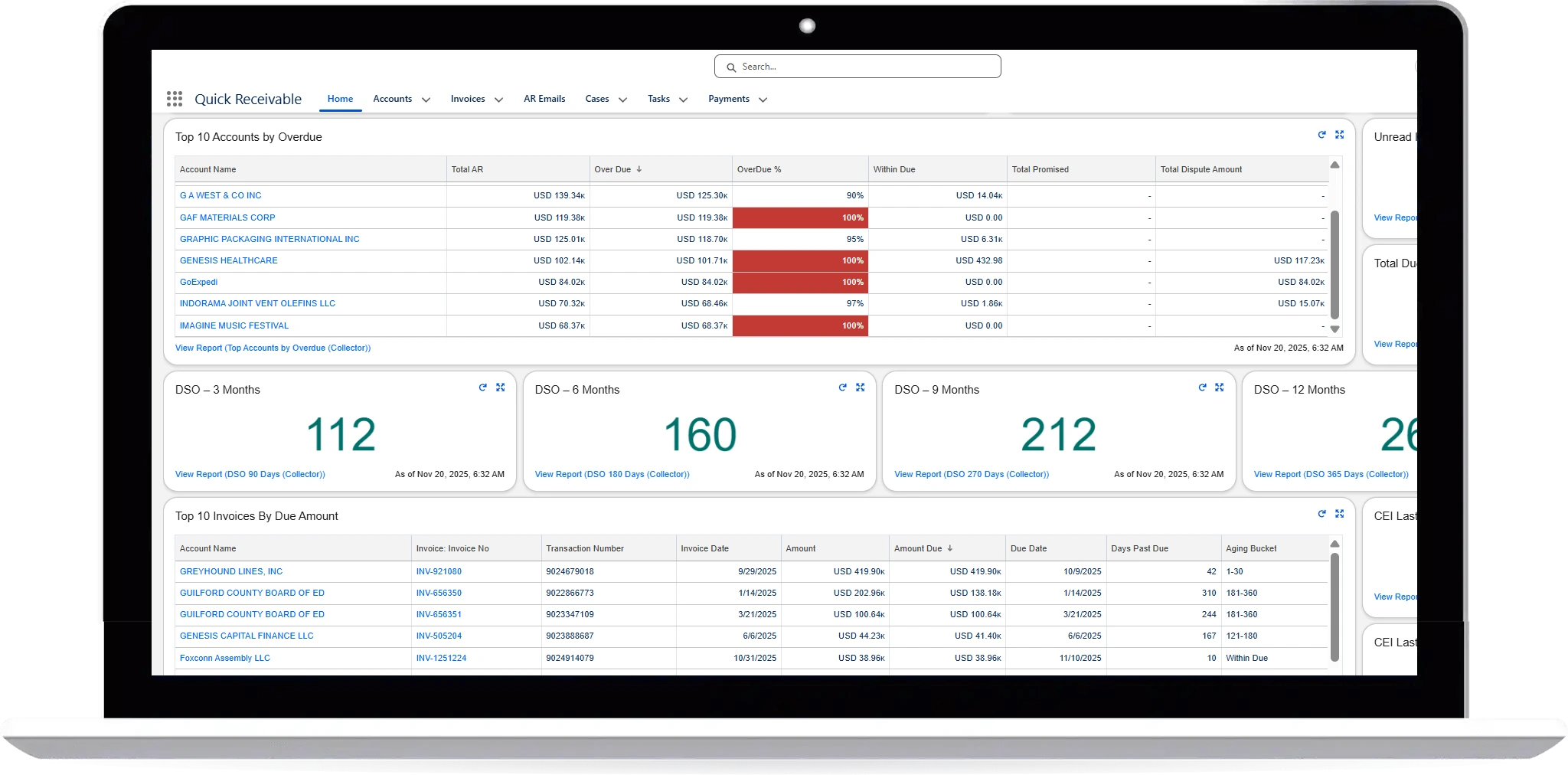

- Smart Prioritization: Score and prioritize accounts based on payment history, aging, broken promises, and disputes to focus efforts on high-value opportunities.

- Customizable Dunning Workflows: Design multi-step collection sequences tailored to different customer segments with configurable timing and escalation paths.

- Payment Promise Tracking: Capture payment commitments automatically, send reminders before due dates, and alert collectors when promises are broken.

Business Impact:

- Reduce DSO by 34-40% - Get paid faster with consistent, timely follow-ups

- Increase collector productivity by 3-4x - Handle more accounts with less effort

- Improve collection rates by 25-35% - Smart strategies drive better results

- Save 70% of manual collection time - Free your team for complex cases

- Reduce bad debt write-offs by 20-30% - Catch problems before they escalate

- Enhance customer satisfaction - Professional, consistent communication